Mobile Banking App

Other ways to bank

Other ways to bank

Our Mobile Banking App gives you a convenient way to bank on the go, pay bills, manage your cards and much more. Download the App today.

Learn more

Google Pay™

Google Pay™ is the fast, simple way to pay at millions of places – on sites, in apps, and in stores.

Learn more

Heritage Online

Whether you're on the go, at the office or at home, Heritage Online lets you manage your accounts in one place, at a time that suits you.

Learn more

SMS and Email Alerts

SMS and Email Alerts makes it even easier to keep track of significant actions on your accounts. When one of your chosen Alerts is triggered, you'll receive real-time notification, to your mobile phone or inbox.

Learn more

Banking Branchless

No matter where you’re located, we have banking solutions to help you including 24/7 service, online account opening, Bank@Post and much more.

Learn more

Garmin Pay

Add your Heritage Visa credit or debit cards to Garmin Pay™ and make secure contactless payments on the go.

Learn more

PayID

Forget your account number and BSB! Get paid to your email address or Australian mobile number when you set up a PayID with Heritage.

Learn more

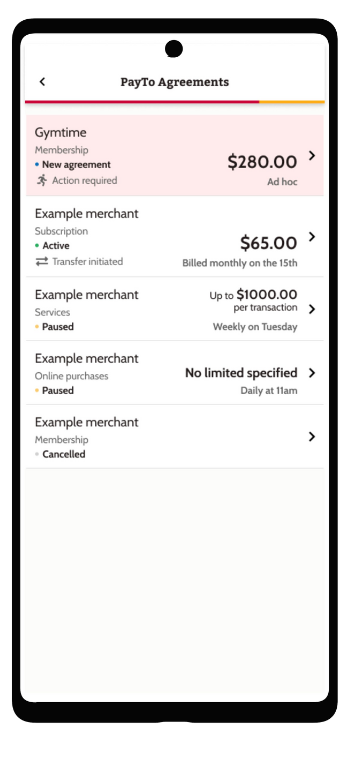

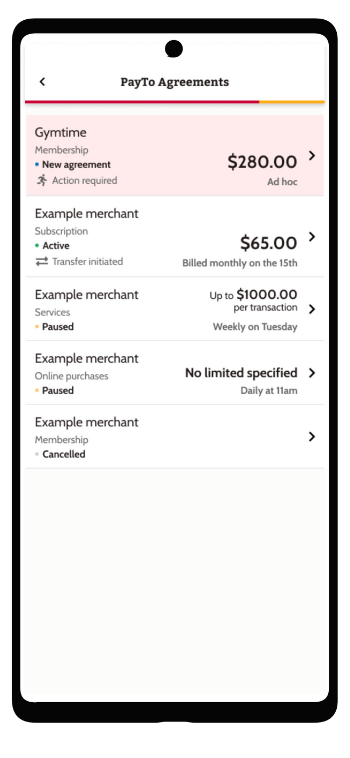

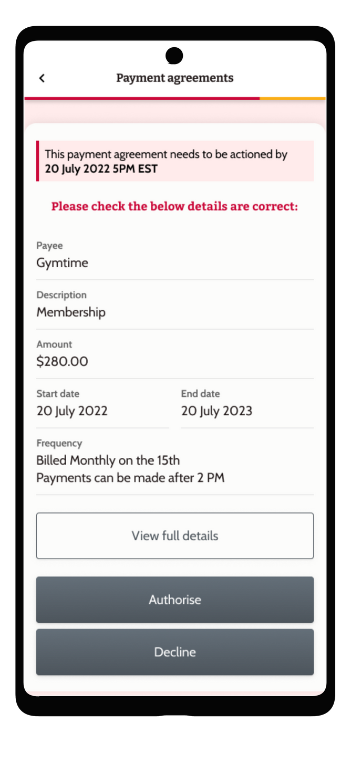

PayTo

PayTo is an easy, digital way to pay businesses directly from your Heritage Bank account.

Learn more

Phone Banking

Run out of data or don't have a smartphone? You can still check your balances and perform basic transactions from any phone, including landlines, with Heritage Access Line.

Learn more

Samsung Pay

Samsung Pay is the smart wallet which allows you to easily make payments using your Samsung device.

Learn more