PayTo FAQs

Do you want to learn more about PayTo with Heritage Bank? Get started with our FAQs.

What is PayTo?

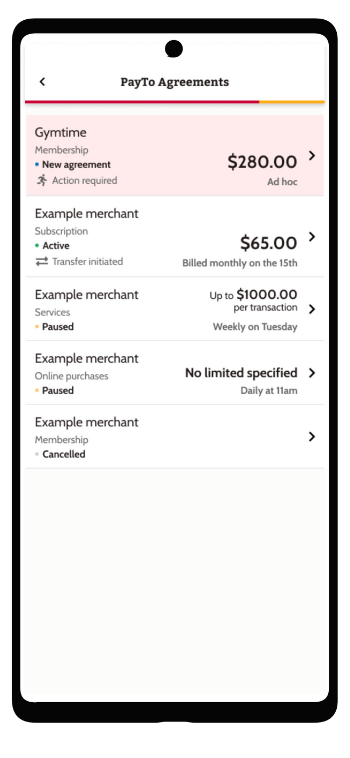

PayTo is designed to help you get more control over your payments by allowing you to authorise and view PayTo agreements within your Mobile Banking App.

PayTo is not replacing direct debits, but is a new alternative.

PayTo will be available for payments at participating businesses. This may include recurring bills that were typically paid through direct debit, or in-app and online purchases that previously relied on your card details.

What is a PayTo agreement?

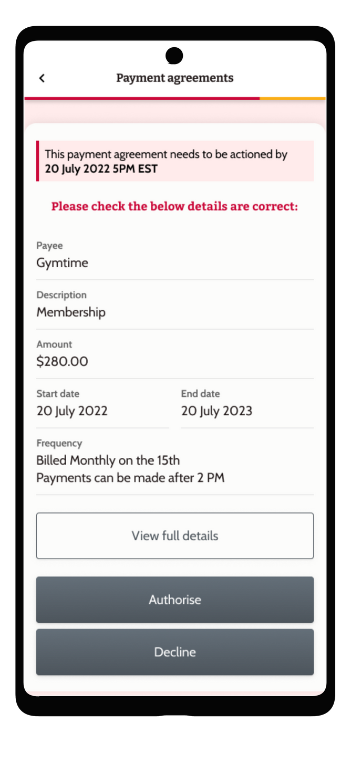

A PayTo agreement is the record of authorisation between you and the business you are paying. It uses specific terms which we've explained more below.

- Payee - The business initiating and receiving your payment.

- Payment amount - The amount(s) authorised or to be authorised by you

- Frequency - How often payments may be debited from your bank account.

- Agreement type - Type of agreement, for example, whether it's fixed or variable.

- First and last payment due date - Date on which your first and last payment may be debited.

- Description - Description of your agreement.

- Start date and end date - First and last date that the agreement may be used for initiating payments from your bank account.

- Action By Date - When the agreement needs to be approved/actioned by you, before it expires.

- Payer - Identifies you. This will show the name/s on your account.

- Linked Account - Your account which will be debited. This will show your BSB and account number or a PayID, depending on what you've selected.

- Automatic Renewal - If the Payee has requested automatic renewal of your payment at the end date

- Payment Reference - A key reference identifiable to you, which may help you identify transactions more clearly in your transaction history.

What account can I use for my PayTo agreement?

When you set up a PayTo agreement you'll need to nominate an account for your payment to come from.Our most popular eligible accounts are:

- Simply Access

- Online Saver

- Pension Plus (no longer for sale)

- Mortgage Crusher

- Business Access

- Club Cheque (no longer for sale)

- Business Overdraft

PayTo agreements cannot be linked to loans, credit cards or accounts where direct debits are not available.

If a business tries to set up a PayTo agreement from an excluded account, they will receive an error and will need to try again with a different Linked Account.

How do I authorise or decline a PayTo agreement?

If you'd like to authorise or decline a PayTo Agreement, it's easy in your Mobile Banking App.

How to

- Login to your Mobile Banking App to get started.

- Go to the ☰ menu and select PayTo agreements.

- Select the PayTo agreement you'd like to action.

- Review the details. Select your choice of Authorise or Decline then follow the prompts.

Other ways to authorise or decline a PayTo agreement

- Call us 24/7 on 13 14 22 or visit your local branch.

- If you do not authorise or decline the PayTo agreement by the Action By Date, then the PayTo agreement will expire. The Payee will be made aware and no money will be debited from your account.

How do I know if a business uses PayTo?

Keep an eye out for the PayTo logo. Participating businesses will display this logo if they are offering PayTo as a way to pay.

How does PayTo work if my account is two or more to sign?

If you have an account that is two or more to sign, you will have view only access for your PayTo agreements in our Mobile Banking App.

All authorised members will need to provide their authority individually to make changes. Once the last member has provided their authority the requested action will take place.

If you are required to take action on your PayTo agreement contact us 24/7 on 13 14 22 or visit your local branch. We can help you approve, decline, pause, resume and cancel payments and change linked accounts.

If the payment is not approved by the Action By Date it will expire. The Payee will not be able to take any money, and they will be notified.

ⓘ An account that is two or more to sign means any account where there is more than one signing authority.

Will my PayTo payment be processed if I have insufficient funds?

No. If you have insufficient funds at the time of the payment, it will be declined and the merchant will be notified of the missed payment.

If you know a payment is coming out that you won't have sufficient funds for, you are able to make changes in your App such as pausing the payment or linking it to another account. However it's important that you check your contractual obligations with the merchant you are paying and verify whether doing so will impact your service.

Can I cancel a PayTo agreement early, before the agreed end date?

You may choose to cancel your PayTo agreement at any time.

Before you cancel, you should check your contractual obligations with the Payee and whether you are still required to pay. You must also understand that:

- The Payee will no longer be able to debit payments from your account for this PayTo agreement.

-

The Payee may be notified that you have cancelled the PayTo agreement.

- This won't cancel any other PayTo agreements you have with that Payee. Each agreement has to be managed separately.

A complete range of how to's and step-by-step guides to help you with your internet banking at Heritage.