We're running scheduled maintenance from 10:00 pm (AEST) Tuesday, 10 June to 5:00 am (AEST) Wednesday, 11 June. App and Internet Banking will be unavailable over this time.

Find out more

How to save without trying

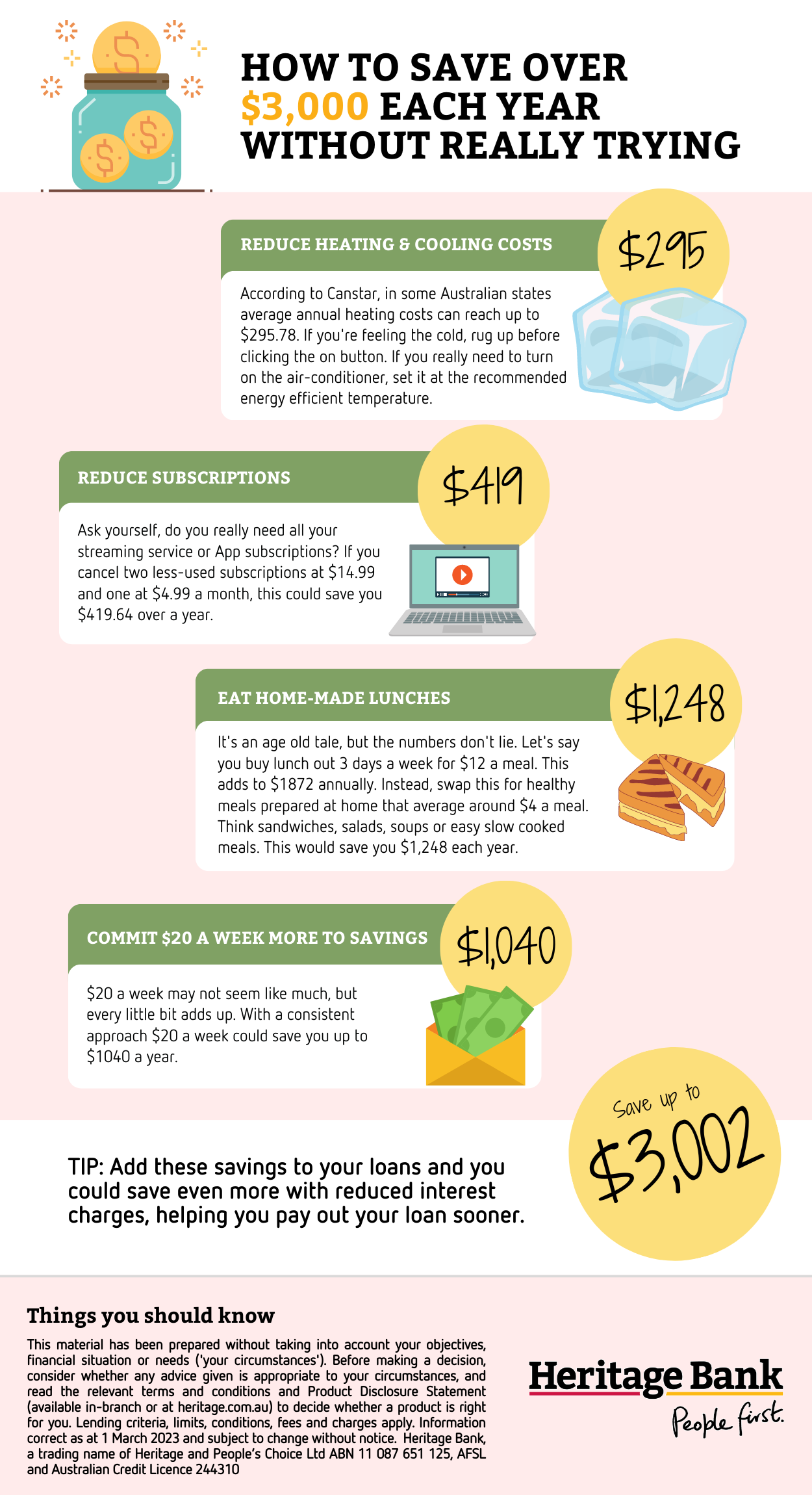

It’s not always easy to save money but these useful tips show you how a few simple changes can really make a difference to your saving efforts!

Saving more is a great goal to have, but how do you save without trying? Everyone has bills and commitments that see your pay check dwindle quickly.

It's important to enjoy your lifestyle. You don't want to feel guilty for the occasional dinner with friends or activity day with your family. But it's all about balance! If you are struggling to cut back on costs, the following infographic details some easy ideas that you might like to consider, to boost your savings efforts by up to $3,000 over the year.

How to save without trying

With these tips, you can have more money in your savings to go towards paying off your loans or your next big holiday. If you'd like to calculate your savings plan, our online savings calculator can help you. Heritage also has savings accounts that may help you reach your goal sooner.