Customer Owned Banking

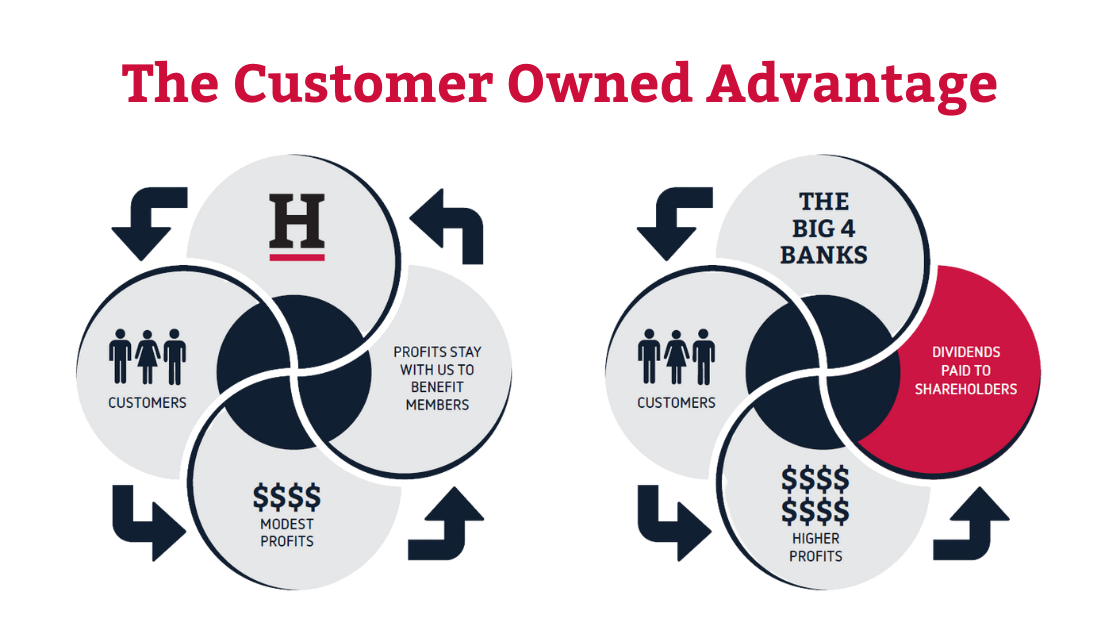

Heritage Bank has grown from our origins in Toowoomba in 1875 to become one of Australia’s largest customer-owned banks. Heritage is proudly customer-owned and committed to giving back to the communities we serve.

About this Rate

In March 2023, Heritage Bank entered a new phase in our history, by merging with People’s Choice Credit Union to create Australia’s leading member-owned banking organisation. While we have now come together as a single organisation, we will continue to operate under the Heritage Bank and People’s Choice brands for an interim period while we continue our integration process. After that, we will adopt a single new brand, but we are fully committed to maintaining our member-owned status.

More than 5 million Australians choose to bank with a customer owned bank. This is because banking with a customer owned bank benefits you and your wider community. These benefits include:

1. People before profits

Customer owned banks don't ask 'how can we make the most money?' we ask 'what is best for the customer?'. With this people first approach, customer owned banks consistently deliver award-winning products and have high customer satisfaction levels.

2. A strong history

Customer owned banks have been around for many years, and with this history, comes trustworthiness and an understanding of what's truly needed to support customers to achieve their money goals. We've innovated and grown along the way to meet our customers needs, and sustainability is at the forefront of all we do.

3. Community focus

Customer owned banks pride themselves on giving back to the community through sponsorships and community banking. At Heritage, we have a widespread sponsorship program, community branches and give back to our community through our philanthropic partner - the Heritage Bank Charitable Foundation.

4. Customer Owned Banking Code of Practice

The Customer Owned Banking Code of Practice was introduced by the Customer Owned Banking Association. The Code includes key promises given by customer owned banks, to ensure fair and ethical dealing with customers. While the Code is not mandatory to, it is recommended. We follow the Code closely at Heritage which you can learn more about here.

Who is the Customer Owned Banking Association?

The Customer Owned Banking Association (COBA) is the leading body for Australian mutual financial institutions including mutual banks, building societies, credit unions and friendly societies. They are a strong public advocate, pushing for more banking competition and a fairer operating system to help our industry challenge big bank market dominance.

If you'd like to make the switch to Heritage Bank, we're here to help you through the process and beyond. Find out just how easy it can be.