Landlord Insurance

A residential investment property should be appropriately insured. Landlord Insurance can give you the confidence that your property will be covered should something go wrong.

The better you understand your policy, the easier it will be if you ever have to claim. Here is a limited summary of the benefits of a landlord insurance policy. For full details, of the standard terms, conditions, limits and exclusions that apply please read the Product Disclosure Statement (PDS) before making a decision to purchase the insurance. The Landlord Buildings and Landlord Contents Key Fact Sheets (KFS) also sets out some information about the cover. Select the cover to suit your needs.

Effective 22 February 2021

Cover for the unexpected

Allianz offers cover for your investment property for out of the ordinary but devastating events such as fire7, storm7 and burglary.

Legal liability

Allianz will cover your legal liability up to $20 million for payment of compensation relating to death, bodily injury or illness, and/or physical loss of or damage to property caused by an accident (or series of accidents). If you have contents cover only, it does not cover any legal liability you may incur as owner of the buildings unless the buildings are defined as a lot.

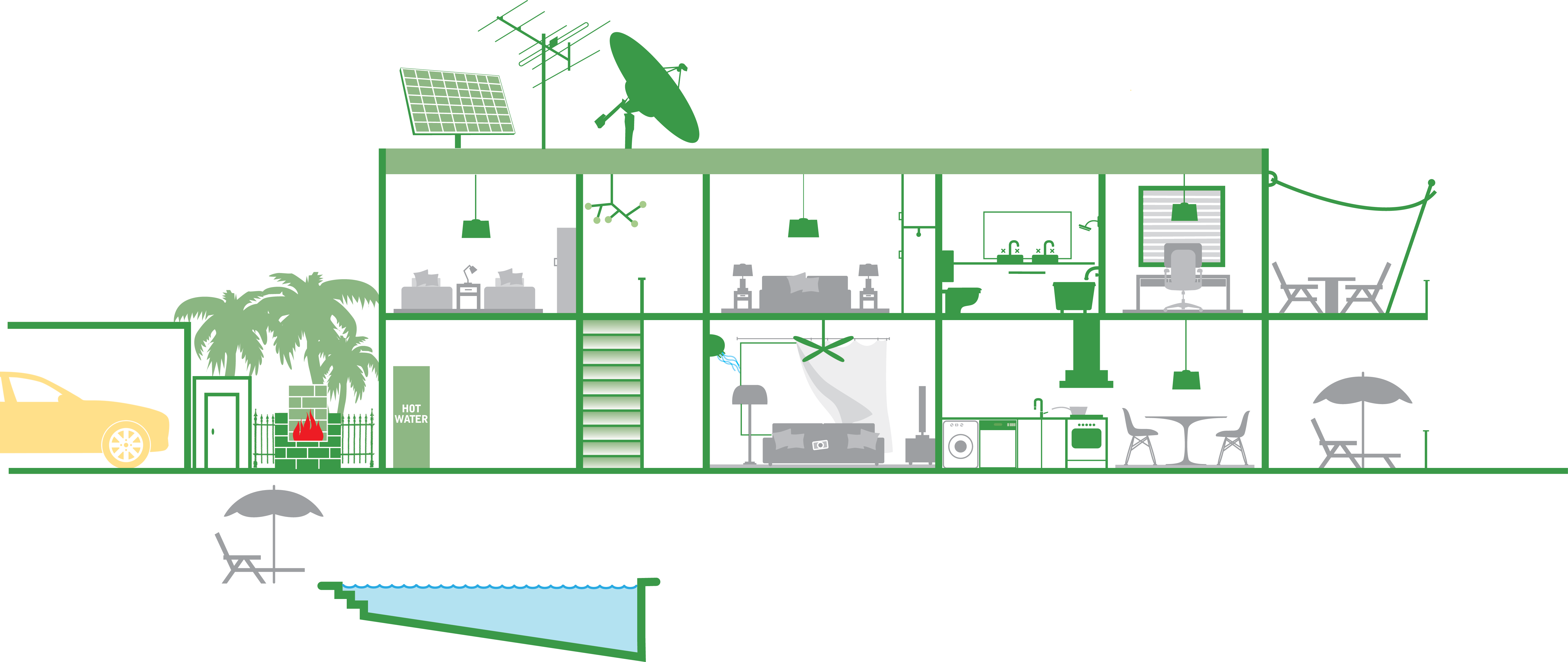

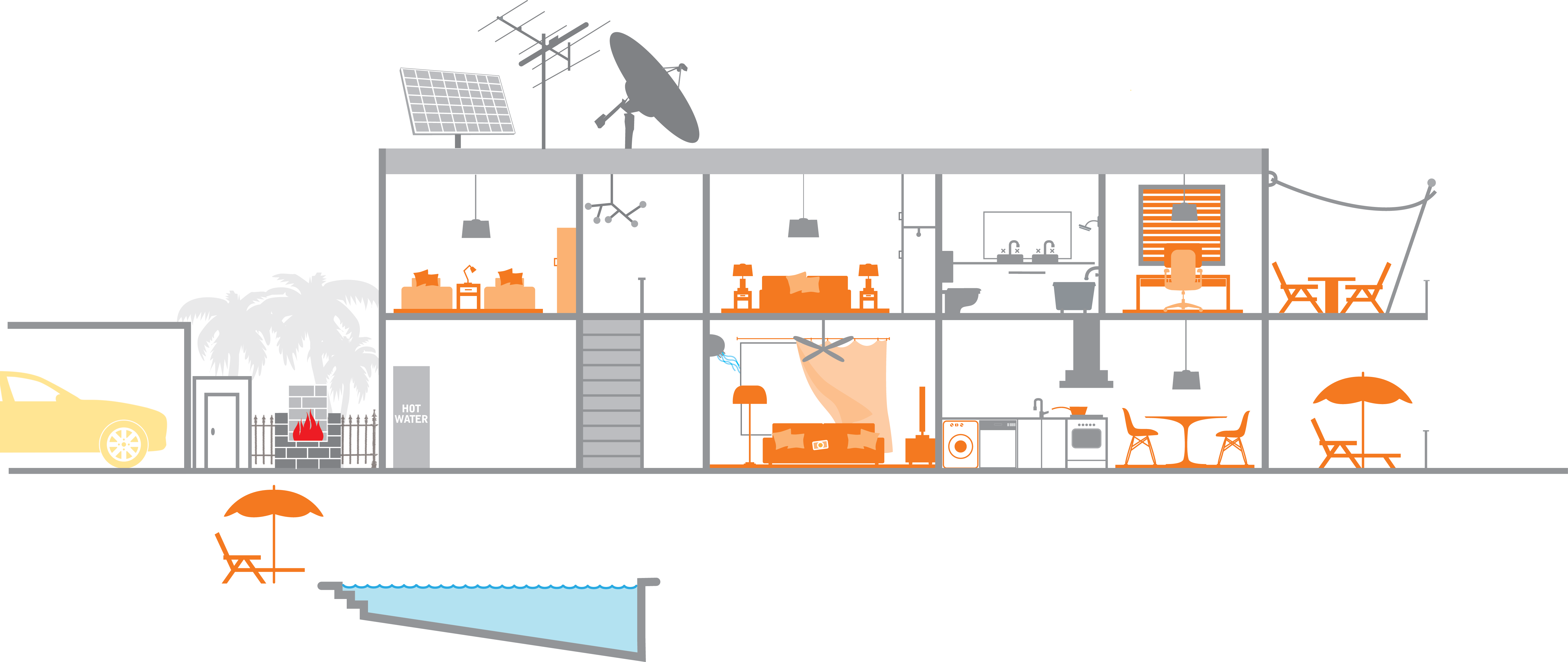

Making your buildings environmentally friendly

If you have buildings cover and your buildings are totally destroyed and need to be rebuilt, in addition to your buildings sum insured, Allianz will pay up to $5,000 (after deduction of any government or council rebates) to help you make the new buildings more environmentally friendly.

Landlords contents

Allianz will pay for repair or replacement of contents you own and provide for your tenant’s use as a result of an insured event. If you have buildings cover only, Allianz will pay up to the lesser of $10,000 or the remainder of the sum insured after payment of the buildings claim, for certain landlords contents under this additional benefit.

Rental costs after an insured event

If your buildings are damaged by an insured event and can’t be lived in by your tenant, or access to or use of the buildings is not possible for at least 7 days after an insured event Allianz will pay for your loss of rent on the buildings for up to 12 months if you have buildings cover or if your building is part of a strata title development and you have contents cover only.

Rebuilding and professional fees

If you have buildings cover and need to rebuild your buildings after total loss or damage, Allianz will help pay the reasonable costs of architects, engineers, surveyors and solicitors up to $5,000.

Debris removal

Allianz will pay up to 10% of the building and/or contents sum insured for removing debris from your insured address if your buildings are damaged or destroyed by an insured event.

24/7 online claims lodgement

When you need to make a claim Allianz are there for you with 24 hour claims lodgement available online, or you can call the claims line to commence the claims process over the phone.

Contents in the open air at the insured address

If you have contents cover, Allianz will cover contents in the open air (that you own and that you have provided for your tenants use) which have been lost or damaged by an insured event covered by your policy, up to a maximum amount of $1000.

Apply to add any of these optional Landlord Insurance covers for an additional premium and greater cover.

| Optional cover | Description |

| Landlord workers’ compensation cover | Cover for the compensation amount you are liable to pay if you employ a domestic worker and they are injured while working for you at the insured address. Only available in ACT, WA and TAS. |

| Flood cover | Flood cover may be available as an optional cover added to your Landlord buildings and/or contents policy for an additional premium. A 72-hour exclusion period applies7. |

| Rent default & theft by tenant | Option to be covered for loss of rent due to specified rental defaults, up to $10,000 in total for all claims during the period of insurance. Cover for loss or damage to your insured buildings or contents caused by theft, burglary or housebreaking committed by your tenant or invitees of your tenant. |

Remember, Allianz will only pay up to the amount of your loss or the sum insured, whichever is the lesser (subject to the policy terms and conditions) - so you should also be careful not to over insure. That's why we've provided these calculators. They work as guides to help you estimate the replacement value of your landlord buildings and contents.

What do I do if I need to make a landlord insurance claim?

Do what you reasonably can to prevent further loss, damage or liability. Tell the police as soon as reasonably possible about any malicious damage, theft, attempted theft, burglary or loss of insured property. Contact the Claims Call Centre on 1300 555 030 and advise the Claims Consultant of what has happened: the Claims Consultant will help you through the landlord insurance claims process.

In order to be sure that you are covered under this policy you should always contact us for approval before you incur expenses you wish to claim. If you do not, we will pay for expenses incurred to the amount we would have authorised had you asked us first.

Am I covered for Flood?

How do I know if I have optional covers on my policy?

Who is Landlord insurance policy designed for?

This insurance policy has been designed for people who are renting their property out to tenants under a residential rental agreement.

Contents owned by you (or for which you are legally responsible) and provide for the use of the tenants may also be covered under the policy.

This policy is not suitable for covering the building or contents of the home you live in. In this regard, we offer a home and contents product that has been specifically designed for homeowners or renters.

For more information on Home and Contents insurance, please visit the home and contents product page.

How should I determine the replacement value of my buildings?