The better you understand your policy, the easier it will be if you ever have to claim.

Here is a limited summary of the benefits of a landlord insurance policy. For full details of the standard terms, conditions, limits and exclusions that apply please read the Product Disclosure Statement (PDS), any applicable supplementary PDS before making a decision to purchase the insurance. The Landlord Buildings and Landlord Contents Key Fact Sheets (KFS) also sets out some information about the cover.

Cover for the unexpected

Allianz offers cover for your investment property for out of the ordinary but devastating events such as fire7, storm7, flood7, and burglary.

Cover for flood and/or run-off

Covers loss or damage caused by flood7, run-off, flood water7 combined with run-off and/or rainwater.

Legal liability

Allianz will cover your legal liability up to $20 million for payment of compensation relating to death, bodily injury or illness, and/or physical loss of or damage to property caused by an accident (or series of accidents). If you have contents cover only, it does not cover any legal liability you may incur as owner of the buildings unless the buildings are defined as a lot.

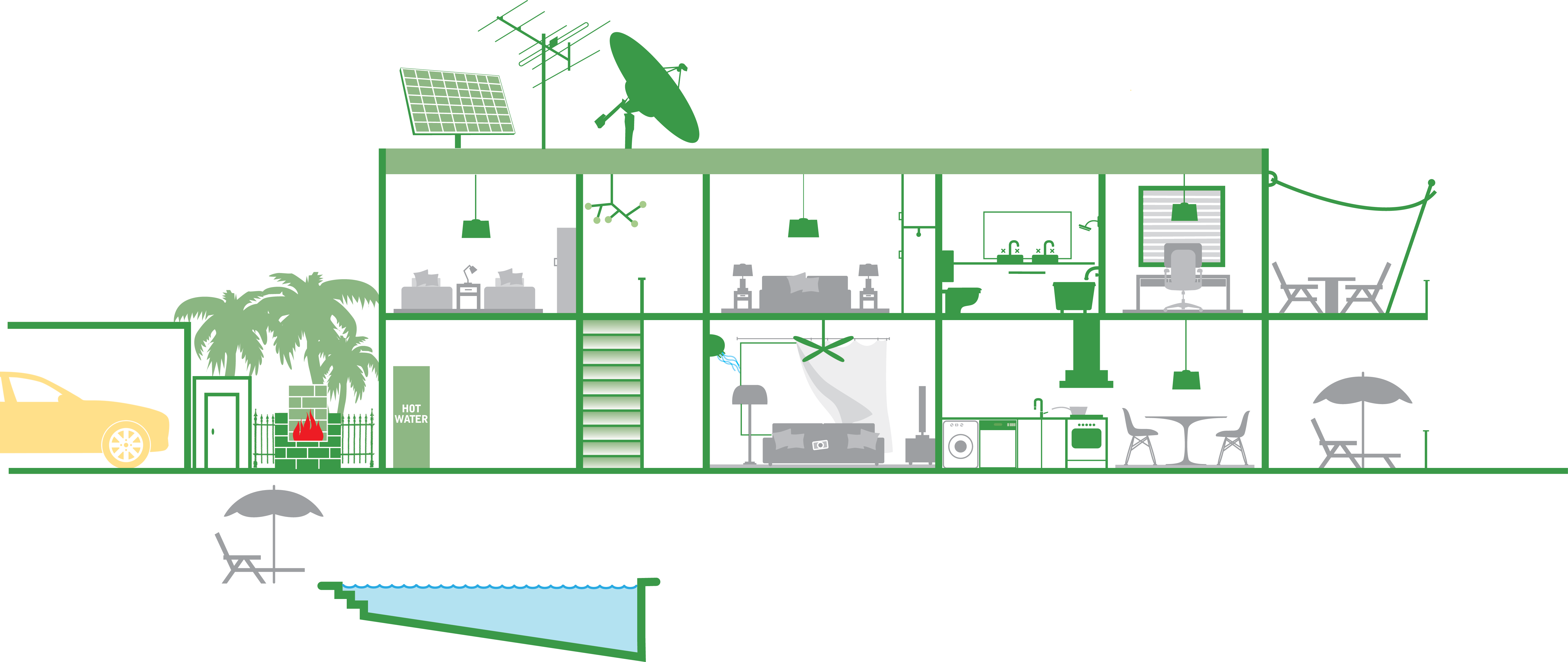

Making your buildings environmentally friendly

If you have buildings cover and your buildings are totally destroyed and need to be rebuilt, in addition to your buildings sum insured, Allianz will pay up to $5,000 (after deduction of any government or council rebates) to help you make the new buildings more environmentally friendly.

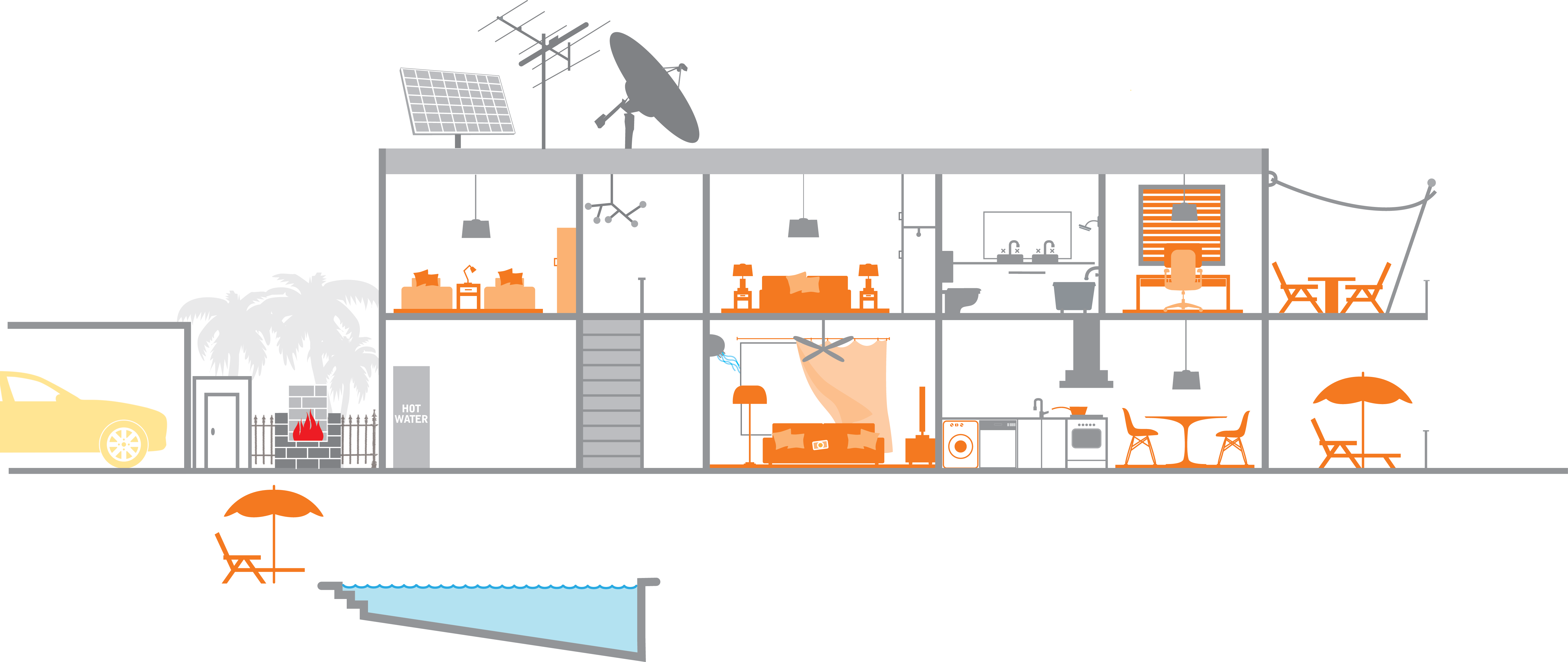

Landlords contents

Allianz will pay for repair or replacement of contents you own and provide for your tenant’s use as a result of an insured event.

If you have buildings cover only, Allianz will pay up to the lesser of $10,000 or the remainder of the sum insured after payment of the buildings claim, for certain landlords contents under this additional benefit.

Rental costs after an insured event

If your buildings are damaged by an insured event and can’t be lived in by your tenant, or access to or use of the buildings is not possible for at least 7 days after an insured event Allianz will pay for your loss of rent on the buildings for up to 12 months if you have buildings cover or if your building is part of a strata title development and you have contents cover only.

Rebuilding and professional fees

If you have buildings cover and need to rebuild your buildings after total loss or damage, Allianz will help pay the reasonable costs of architects, engineers, surveyors and solicitors up to $5,000.

Debris removal

In addition to your buildings and/or contents sum insured Allianz will cover up to 10% of your building and/or contents sum insured for the removal of debris from the damaged or destroyed parts of your buildings.

24/7 claims assistance

When you need to make a claim, Allianz are there for you with 24 hour claims lodgement available online, or you can call the claims line to commence the claims process over the phone.

Contents in the open air at the insured address

If you have contents cover, Allianz will cover contents in the open air (that you own and that you have provided for your tenants use) which have been lost or damaged by an insured event covered by your policy, up to a maximum amount of $1000.

Apply to add any of these optional Landlord Insurance covers for an additional premium and greater cover.

| Optional cover | Description |

| Rent default & theft by tenant | Option to be covered for loss of rent due to specified rental defaults, up to $10,000 in total for all claims during the period of insurance. Cover for loss or damage to your insured buildings or contents caused by theft, burglary or housebreaking committed by your tenant or invitees of your tenant. |

Remember, Allianz will only pay up to the amount of your loss or the sum insured, whichever is the lesser (subject to the policy terms and conditions) - so you should also be careful not to over insure. That's why we've provided these calculators. They work as guides to help you estimate the replacement value of your landlord buildings and contents.

How to make a Landlord insurance claims?

Do what you reasonably can to prevent any further loss, damage, or liability. Tell the police as soon as reasonably possible about any malicious damage, theft, attempted theft, burglary, or loss of insured property.

Start your Landlord Insurance claim online 24/7.

Complete the secure online claim form, and a friendly claims representative will contact you as soon as possible to discuss the next steps.

Alternatively, you can contact the Claims Call Centre on 1300 555 030 to submit your claim. The claims consultant will help you through the home and contents insurance claims process.

Am I covered for Flood?

Flood cover is a Standard inclusion for all Landlord Insurance policies that start from 14 January 2025.

For Landlord Insurance policies starting before 14 January, flood cover was optional. If you’re a renewing customer, you may be able to continue without flood cover if:

You previously opted out and met certain flood risk criteria,

- We weren’t able to offer you flood cover,

- We’ve agreed you can opt-out of flood cover as standard.

For full details of terms, conditions, limits, and exclusions of all our home insurance cover options, please refer to the relevant Product Disclosure Statement any supplementary PDS and Home Buildings or Home Contents Key Fact Sheets.

How do I know if I have optional covers on my policy?

Who is Landlord insurance policy designed for?

This insurance policy has been designed for people who are renting their property out to tenants under a residential rental agreement.

Contents owned by you (or for which you are legally responsible) and provide for the use of the tenants may also be covered under the policy.

This policy is not suitable for covering the building or contents of the home you live in. In this regard, we offer a home and contents product that has been specifically designed for homeowners or renters.

For more information on Home and Contents insurance, please visit the home and contents product page.

How should I determine the replacement value of my buildings?

How is my insurance premium calculated?