Open Banking Australia

Giving you more control over your financial choices and banking data.

Heritage Bank and People’s Choice merged in March 2023 to create Heritage and People’s Choice Limited.

We are now on an exciting journey to bring together our products, services and technology.

From 25 October 2024 when you provide consent to an accredited data recipient you will need to select People’s Choice when choosing to share your Heritage Bank data.

You can see all consents authorised from 25 October 2024 on the People’s Choice Consent Dashboard, accessible through Heritage Online or the Mobile Banking App.

Learn more at Open Banking-Control your banking data | People's Choice (peopleschoice.com.au)

Consents authorised before 25 October 2024, in respect of Heritage Bank branded products, can be withdrawn, but cannot be amended.

You can see all consents authorised before 25 October 2024 on the Heritage Bank Consent Dashboard, accessible through Heritage Online or the Mobile Banking App.

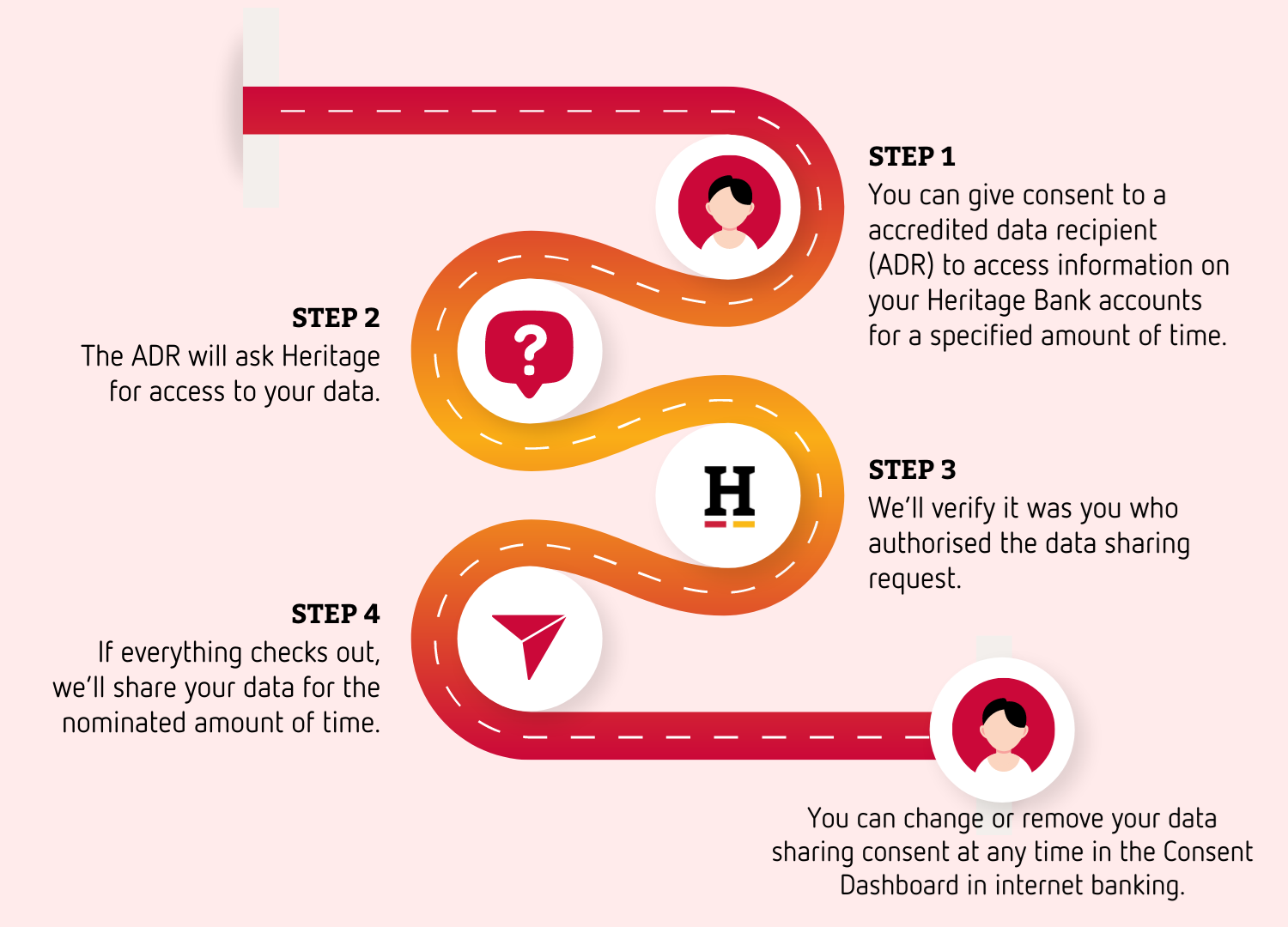

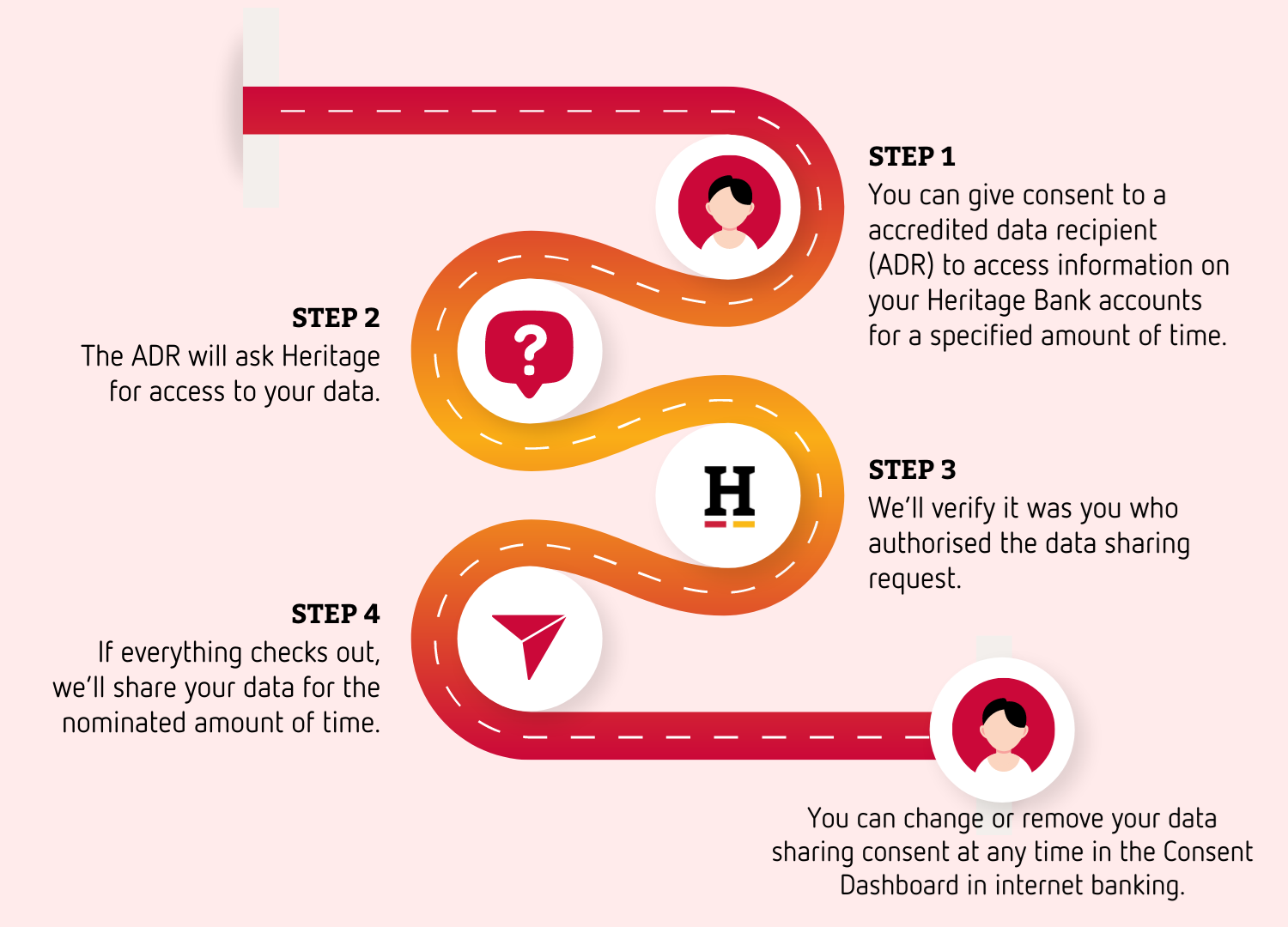

How open banking works - Heritage Bank

How do I manage my Open Banking data sharing consent?

You are in control of when and who you share your data with. You can withdraw or change your existing consents at any time in the Consent Dashboard accessible through Heritage Online or the Mobile Banking App.

What data can I share from my Heritage accounts?

From 1 November 2022, you can consent to share specific data for your personal (individual and joint account) and non-personal memberships, such as transactions, savings, home loans, mortgage offsets, personal loans, business accounts and credit card accounts. You can choose to share all this information, or only certain types of data including:

Bank Account Data

- Savings, transaction and term deposit accounts

- Credit card accounts

- Home loans

- Mortgage offset accounts

- Personal loans

- Closed accounts

Bank Transaction Data

- How many transactions you've done in a period of time

- Any loan repayments

- Any cheque bounces

- Minimum balance with account

- Incoming transactions

- Outgoing transactions

- Direct debits

- Scheduled payments

- Saved payee details

Bank Customer Data

- Name

- Occupation

- Phone

- Email address

- Mail address

- Residential address

Detailed Organisation Data

- Agent name and role

- Organisation name

- Organisation numbers (ABN or ACN)

- Charity status

- Establishment date

- Industry

- Organisation type

- Country of registration

- Organisation address

- Mail address

- Phone number

How do I identify an accredited data recipient?

In this phase of Consumer Data Right, you can only consent to share your data with an accredited data recipient. When you authorise a new sharing consent through a third party, they must be accredited with the ACCC and meet certain rules and safeguards to access your data.

You can check the Register of Accredited Persons at cdr.gov.au at any time to confirm whether a business or person you are considering sharing your data with is accredited. Plus, all accredited data recipients are authorised to display the Consumer Data Right logo.

Will I be charged a fee?

Under the Consumer Data Right legislation, we will not charge you to share your data with an accredited third party.

We won't charge an accredited third party to access your data either.

How do I get in touch with Heritage about Open Banking?

There are several ways you can get in touch with us if you have questions about Open Banking.

In person

Visit your local Heritage Bank branch and talk to our staff

Phone

Heritage Open Banking Team, based in QueenslandAustralia: 1300 912 150

Overseas: +617 4694 9000

Email:

Mail:

Open Banking

Heritage Bank

PO Box 190

Toowoomba QLD 4350

Website:

Visit our contact us page and complete the online form.

Once Open Banking is introduced Australia-wide it could change the way you compare products and services between banks.

- Open Banking provides the framework for accredited third parties, such as app developers, to create new financial tools and services that use Consumer Data Right data to provide more personalised services.

- Sharing your banking data with these third parties is by opt-in only. You’re in control of your data and you can stop sharing your data at any time.

- Once these third party tools and services are created, you may be able to more easily compare products across banks and access more accurate budgeting tools. You may even be able to see one view of your bank accounts across multiple financial institutions.

Product data

As part of the first stage of Open Banking, Heritage shared publicly available information, such as product rates, fees and features across our products. We shared this information via APIs (application programming interfaces) for third parties to access. This means that third parties such as comparison websites or financial planners, can use this general information to compare bank products for you and find a product that fits best.Consumer data

From 1 November 2022, you can share Bank Account Data on personal (individual and joint account) and non-personal memberships including home loans, offset accounts, personal loans and business accounts. You can also share more data such as information on direct debits, scheduled payments, your regular payees, recurring payment details and closed accounts. Once you've authorised an accredited data recipient to access your data, you can manage this consent anytime in your Consent Dashboard, accessible through Heritage Online and the Mobile Banking App.

At Heritage, protecting your privacy is our priority. We understand that giving a third party access to your banking data may seem a little daunting. Rest assured, Open Banking has privacy protections in place that will ensure your data is shared safely and securely. The protections include:

- You choose if you want to participate and who you share your data with.

- Before any company can request access to your data through Open Banking or seek your permission to see your data, they’ll need to be accredited by the ACCC.

- You can manage which data you share and cancel sharing at any time.

- You can ask for your data to be deleted by the third party.

- You can authorise third parties to access your data for a nominated time, up to 12 months.

- After 12 months, third party access to your data will automatically expire. This means they won’t have access to your data for an indefinite amount of time.

Are you an existing Heritage member?

This will determine how best we can help.