What is a bridging loan?

Finding a new home to buy can be a really fun and exciting process, but what happens if you’ve found your dream home and are yet to sell your existing one?

You may not have put your existing home on the market yet or you may be waiting for the right buyer to come along – either way, one of the options for you to get into your dream home could be a bridging loan.

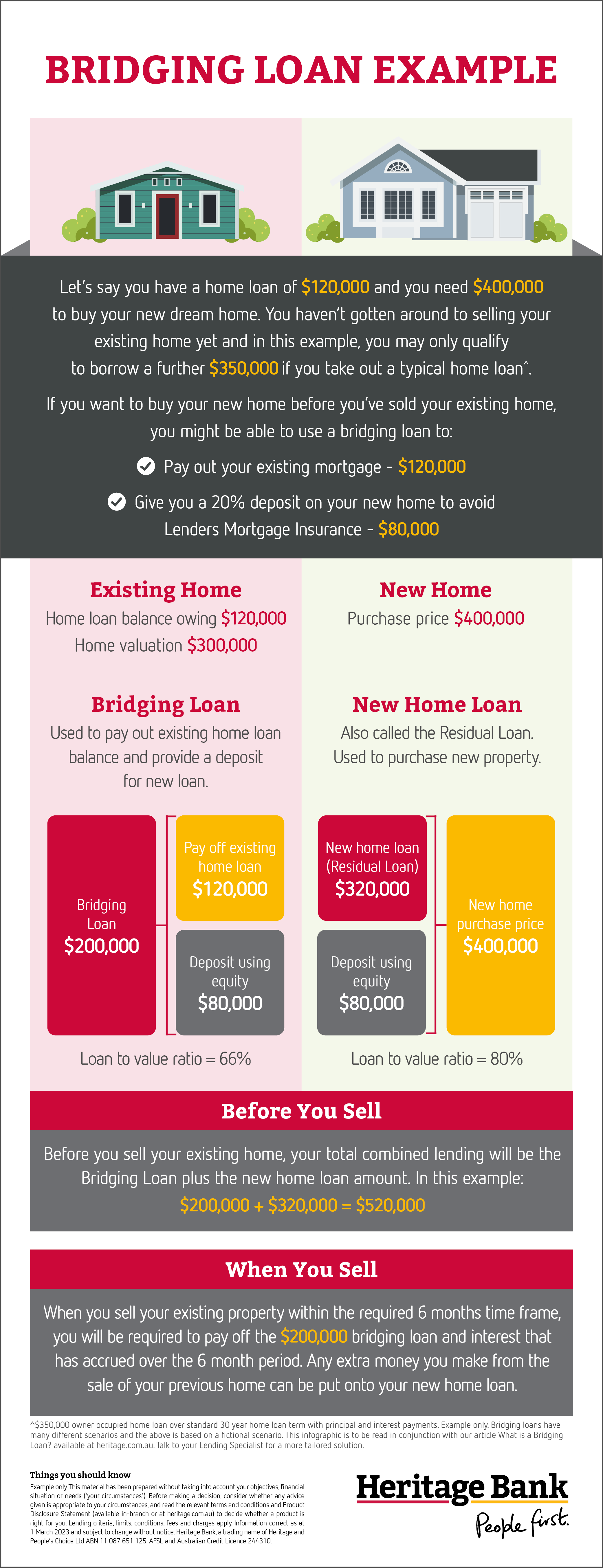

A bridging loan is a short-term loan which can bridge the gap between the purchase price of your new home and maintaining your existing mortgage until your existing home is sold. It allows you to access the equity in your existing home as security for the deposit towards your new dream home.

How does it work?

Bridging loans provide short-term home finance and are approved on the basis the homeowner will be selling their existing property shortly after the purchase of a new property.

A bridging loan can work where you cannot afford, or do not want to make repayments, on two home loans in the time between settling on your new property and selling your existing property. It may also be an option if you do not have the borrowing capacity to maintain two long-term mortgages.

Instead, a bridging loan can allow you to use the equity in your existing home to act as security for the deposit for your new home. Then, the balance of the bridging loan is then paid out when you sell your existing property.

Residual loan

When you take out a bridging loan you also need to take out a residual loan.

The residual loan covers the difference between the equity you’ve accessed as a deposit and the balance needed to purchase your new home. A residual loan is normally just a standard fixed or variable owner-occupied home loan for your new property. It is usually a requirement for most lenders that the bridging loan and residual loan are taken out at the same financial institution.

After you sell your existing property, you would continue to pay the residual loan down according to your payment schedule. You may also choose to make a lump payment when you sell your existing property.

What is a bridging loan example infographic - Heritage Bank

Learn more

Repayments

As a bridging loan is designed to be paid out when you sell your existing property, there are usually no repayments necessary during the term of the loan however interest will accrue over the term. With Heritage, you can make early or periodic repayments before the end of the term onto the loan without penalty, however it isn’t required during the standard term of six months.

Interest

At Heritage, our bridging loan has a variable interest rate with interest calculated daily. The interest is added to the loan balance on the last day of each month however, the full loan balance including the interest accrued and charged over the period is not due to be paid until the loan is required to be repaid in full.

Security

The security used for your bridging loan is your existing property. The security used for your new loan is the new property you choose to purchase. Depending on the terms of the relevant mortgages, the loans may both be secured by both properties.

Loan to Valuation Ratio (LVR)

You may notice that bridging loans have lower maximum LVR restrictions than normal loans. This makes it more likely that the bridging loan will be cleared in full upon the sale of the existing home and avoids the need to pay Mortgage Insurance.

At Heritage, our allowed maximum LVR on bridging loans is normally 72%. For the definition of LVR or to learn more about common banking terminology, check out our article on Breaking Down Banking Jargon.

What if I’m unable to sell my existing property within the standard loan term?

At Heritage, our standard loan term is 6 months however this may vary across financial institutions. This means that from the date of settlement of your bridging loan and purchase of your new property, you have 6 months to sell your existing property.

If you do not sell within 6 months, you may be able to negotiate with your lender and apply to extend the term of your bridging loan. If this application is approved you may be granted another 6 months or a further additional time frame to sell your property. If your application is not approved by your financial institution there may be other options you can discuss with your lender such as converting the loan into a standard principal and interest loan.

If you were unable to repay the loan at the end of the term, this could be considered a default. It's important to be aware that this could result in penalty interest, fees or other costs that you may have to pay. If you’re unable to convert the loan into a standard loan (non-bridging loan) or sell the property, there is a risk that your lender would have to complete a mortgagee-in-possession sale in which they sell the property for you. This could result in a potential loss.

That's why it’s very important for you to review your credit contract in detail before you take out a bridging loan. We also recommend that you seek independent legal and financial advice before deciding what is right for you.

Bridging loan alternatives

An alternative to a bridging loan could be applying for an additional home loan to purchase your new property. To do this, you would need to be able to make repayments on both mortgages and be able to qualify for both loans.

To find out whether a Heritage Bridging Loan could be an option for you and discuss alternatives, enquire online, visit your local branch or contact us on 13 14 22.