Heritage Bank Community Branch in Forest Lake

- Full branch services

- ATM

- Coin Counter

- Business banking

- Community Branch

- Financial planning

Services

- Foreign currency

- Insurances

- Internet Banking kiosk

- Investments

- Mortgages

- Personal lending

- Transaction accounts

It all started with the people...

Officially opening in 1991, Forest Lake was the first Master Planned Community within the municipality of Brisbane. From its opening, the community began to attract a constant stream of residents thanks to its family-friendly atmosphere and carefully crafted mix of retail, commercial, educational, residential, retirement, and recreational facilities.

However as a planned community, Forest Lake residents only had access to one bank in the local shopping centre. This meant the residents’ financial options were limited, so they began to look for another option – one that not only gave them more financial choice but helped the community grow.

The Heritage Community Branch model was the answer. A savvy group of local investors came together to raise over $221,000 in capital to partner with Heritage to open the Heritage Forest Lake Community Branch. The Branch was officially opened in October 2005 by then Lord Mayor Campbell Newman.

Heritage Forest Lake Community Branch is a joint venture partnership between Heritage Bank and the local community, represented by Forest Lake One Community (FLOC). Besides providing local access to comprehensive financial services, profits from the Branch are distributed back to the community in the form of Community Grants. These grants are used to support charities, sporting clubs and other local organisations.

Ongoing success

Since opening in 2006, Heritage Forest Lake Community Branch has injected over $11.5 million back into the community through grants, sponsorships, local employment and more. The community grants have enabled local organisations to complete numerous essential projects that may have never been possible without the mutually beneficial relationship between FLOC and Heritage.Benefits

-

Locals supporting locals

-

Eliminating travel to do the banking

-

People are more likely to spend their money locally

-

Competitive rates and products

-

Longer trading hours than the major banks

-

A better return for investors

-

Profits going back to the community

Access to better banking products and services

Forest Lake Community Branch provides the community with high quality banking, including fairer fees and better service. The success of the branch however, is thanks to the local people who bank with us knowing their community will get a share of the profits.

There are no account keeping fees on personal accounts. Customers are offered fair pricing, competitive fees and charges, flexible products and more staff to give you higher levels of service.

Profits back to the local community

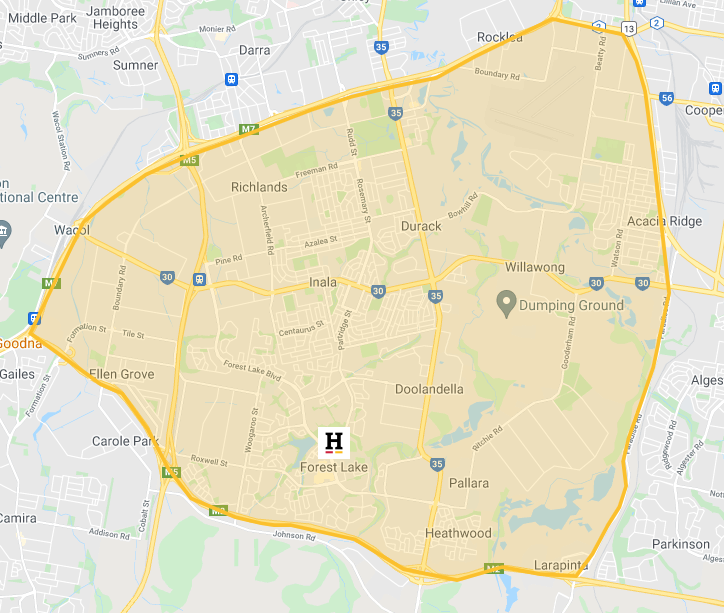

Applications for Forest Lake Community Grants are open all year round. If your Community Group is from Forest Lake or surrounding areas (as marked on the map below), talk to us about applying for a Community Grant. Contact the Forest Lake Community Branch today for more information.

Our Forest Lake Community Grant Map

Are you an existing Heritage member?

This will determine how best we can help.