Refinance your home loan

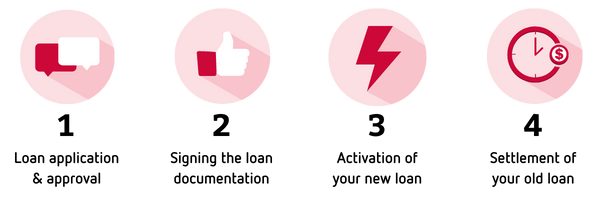

Whether you're looking to save money on your interest rate, reduce your repayments or borrow more for renovations, home loan refinance can be easier than you think. If you'd like to refinance your home loan to Heritage, we're here to help.

I want to borrow

Over

Indicative repayment amount only based on current interest rates. Your credit contract will state a monthly repayment figure. You may make payments as frequently as you choose within each month to pay the monthly amount due.