What is an offset account?

An offset account is a term you may come across when comparing at home loans and their features. But what is an offset account, and what are the benefits?

An offset account is a day to day transaction account that comes with the benefits of reducing the interest you pay on your eligible linked home loan. The amount held in your account will be offset against the balance of the linked home loan and you’ll pay less interest on your home loan. This will directly affect the amount you pay off your loan each month and, over time, will add up and reduce the time it takes you to pay off your loan.

Will an offset account suit me?

An offset account could give you the benefits of reducing the amount of interest you pay while ensuring your funds are still accessible in a transaction account with card or chequebook access. It provides the benefit of easy access to your money. It can suit those who'd like to keep a higher balance in their main transactional account and offset their eligible home loan interest at the same time.

We also have an online redraw option. Online redraw allows you can tap into additional payments you've made on your eligible home or personal loan when you need them, from the convenience of your computer or mobile phone. Instead of keeping your money in an offset account, you could put it directly onto your home loan and access it when you need via online redraw (once registered).

Which home loans can have an offset?

Offset accounts are commonly available on standard variable loans however it may differ between financial institutions. At Heritage, our Mortgage Crusher 100% offset account is available on our Standard Variable Home Loan. You'll also need a minimum balance of $500 to get started. To discuss your offset account options with us, talk to one of our Lending Specialists in branch or phone 13 14 22.

How does an offset account work?

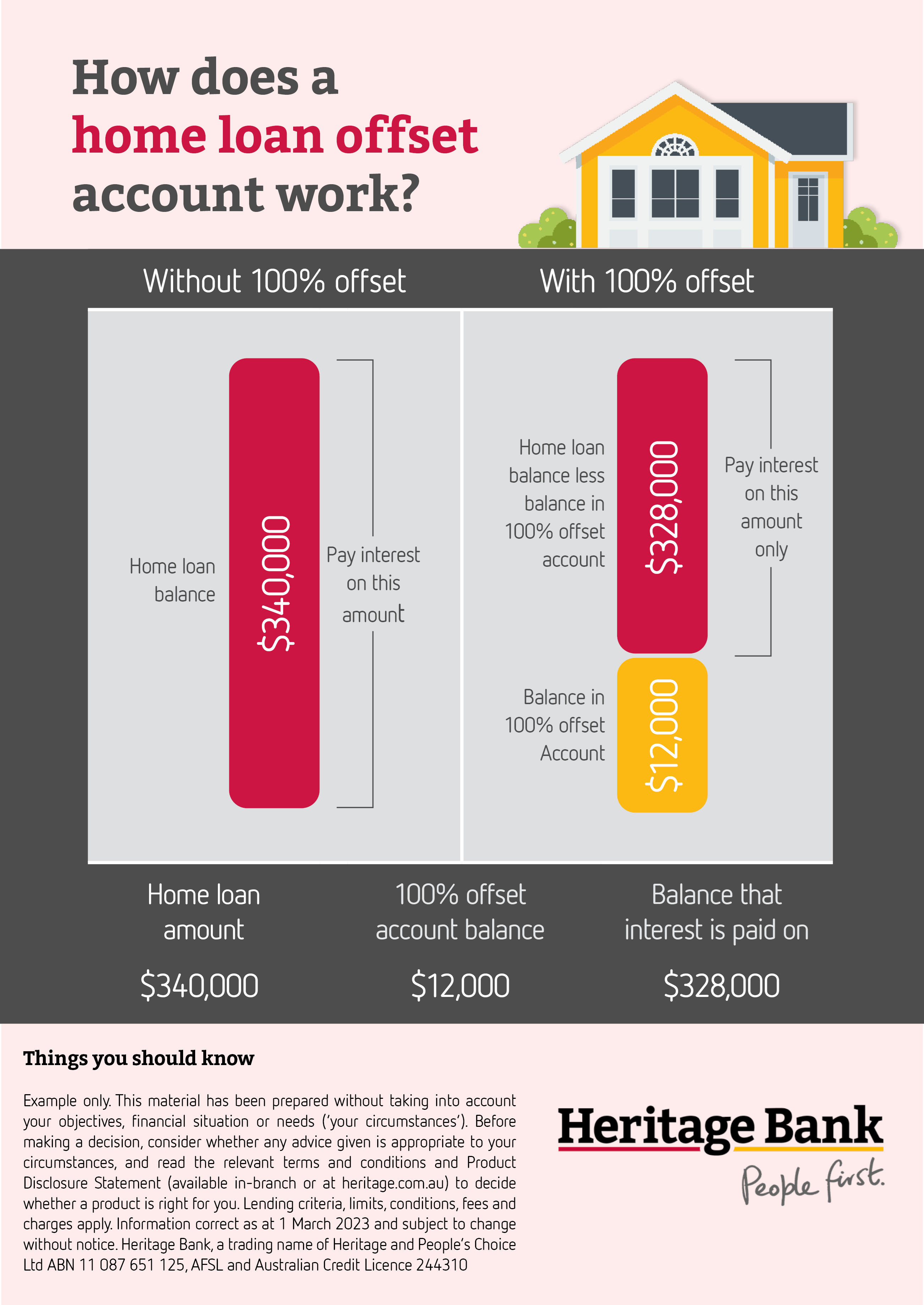

Although different financial institutions may offer varying level of offset accounts, a common option is a 100% offset account. A 100% offset means that the money in the account has the same interest reduction effect as if it was directly on your home loan.

For example, Jenny’s home loan balance is $340,000. She currently has $12,000 in her 100% offset account. This means that Jenny is only paying interest on a home loan balance of $328,000.

If needed, Jenny is able to use the $12,000 at any time. However, by taking money out of her offset account this will directly affect the amount of interest she pays on her loan.

We've illustrated this example in the pop-up graphic below.

What is a home loan offset account? infographic